Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

WALKER & DUNLOP, INC.

7272 Wisconsin Avenue, Suite 1200E

1300

Bethesda, Maryland 20814

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 10, 2018

4, 2023

10:00 a.m. Eastern Daylight Time You are cordially invited to attend our

20182023 annual meeting of stockholders to be held on Thursday, May

10, 2018,4, 2023, at 10:00 a.m., Eastern Daylight Time, at

Hilton Garden Inn

7301 Waverly Street

Bethesda, Maryland 20814

for the following purposes:

1.

To elect eight directors from the nominees named in this proxy statement to serve one-year terms expiring at the 20192024 annual meeting of stockholders;

2.

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018;

2023;

3.

To holdvote on an advisory resolution to approve executive compensation; and

4.

To transact such other business as may properly come before the annual meeting or any adjournment or postponement of the annual meeting.

Only stockholders of record at the close of business on March

12, 201810, 2023 will be entitled to notice of and to vote at the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO SUBMIT YOUR PROXY PRIOR TO THE MEETING BY FOLLOWING THE INSTRUCTIONS FOR VOTING ACCOMPANYING THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR, IF YOU REQUESTED PRINTED COPIES OF THE PROXY MATERIALS, YOUR PROXY OR VOTING INSTRUCTION CARD. IF YOU ATTEND THE MEETING, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON, IF YOU DESIRE, AS DISCUSSED IN THIS PROXY STATEMENT.

By Order of the Board of Directors | | | | |

| | By Order of the Board of Directors |

|

|

|

| | Name: | | Richard M. Lucas |

| | Title: | | Executive Vice President,

General Counsel and Secretary |

![[MISSING IMAGE: sg_richardlucas-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/sg_richardlucas-bw.jpg)

Name:

Richard M. Lucas

Title:

Executive Vice President,

General Counsel and Secretary

Bethesda, Maryland

March

23, 201817, 2023

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders Toto Be Held on May 10, 2018:4, 2023:

The Proxy Statement and Annual Report to Stockholders are available free of charge at http://www.edocumentview.com/WD.

Table of Contents

TABLE OF CONTENTS

| | | | | |

| | | | | 1 | | |

| | Why is this proxy statement being made available? | | | | | 1 | | |

| | Why did I receive a Notice of Internet Availability in the mail instead of a printed set of proxy materials? | | | | | 1 | | |

| | What information is presented in this proxy statement? | | | | | 1 | | |

| | Who is entitled to vote at the annual meeting? | | | | | 1 | | |

| | Who can attend the annual meeting? | | | | | 2 | | |

| | | | | | | 2 | | |

| | | | | | | 2 | | |

| | | | | | | 2 | | |

| | | | | | | 2 | | |

| | | | | | | 2 | | |

| | Will my shares of common stock be voted if I do not provide my proxy and I do not attend the annual meeting? | | | | | 3 | | |

| | | | | | | 3 | | |

What will constitute a quorum at the annual meeting?

| | | | |

How many votes are needed to approve each of the proposals? | | | | | 3 | | |

| | Will any other matters be voted on? | | | | | 43 | | |

| | Who is soliciting my proxy? | | | | | 4 | | |

| | Is there a list of stockholders entitled to vote at the annual meeting? | | | | | 4 | | |

| | How can I obtain a copy of the 20172022 Annual Report and the Annual Report on Form 10-K for the year ended December 31, 2017? 2022? | | | | | 4 | | |

| | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | | | | 5 | | |

| | Proposal 1: Election of Directors for a One-Year Term Expiring at the 20192024 Annual Meeting of Stockholders | | | | | 5 | | |

| | Nominees for Election for a One-Year Term Expiring at the 20192024 Annual Meeting of Stockholders | | | | | 56 | | |

| | Corporate Governance Information | | | | | 910 | | |

| | | | | | | 1719 | | |

AUDIT RELATED MATTERS

| | | | | | 2123 | | |

| | Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | | | | 2123 | | |

| | Disclosure of KPMG LLP Fees for the Years Ended December 31, 20172022 and December 31, 2016 2021 | | | | | 2123 | | |

| | Pre-Approval Policies and Procedures | | | | | 2224 | | |

| | Report of the Audit Committee | | | | | 2224 | | |

EXECUTIVE OFFICERS

| | | | | | 2426 | | |

| | | | | | | 29 | | |

| | | | | | | 2429 | | |

| | COMPENSATION DISCUSSION AND ANALYSIS | | | | | 2631 | | |

| | | | | | | 2631 | | |

| | 2022 NEO Compensation Philosophy Review | | | | | 2834 | | |

Role of Board and Management in Compensation Decisions

| | | | |

Role of Compensation Consultant

| | | 29 | |

Setting Executive Compensation | | | | | 3035 | | |

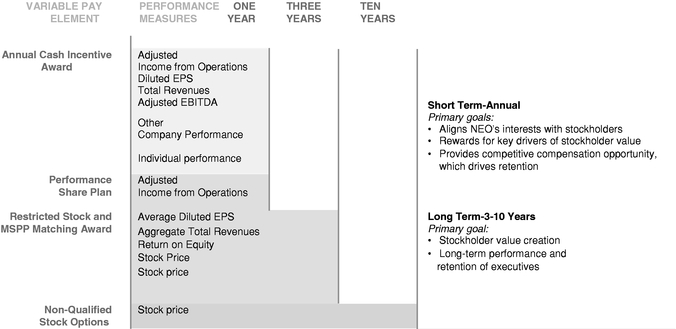

| | 20172022 Key Elements of Compensation

| | | | | 3237 | | |

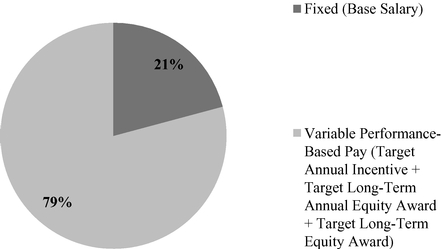

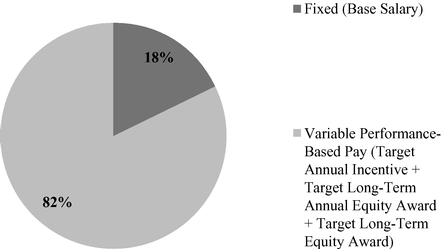

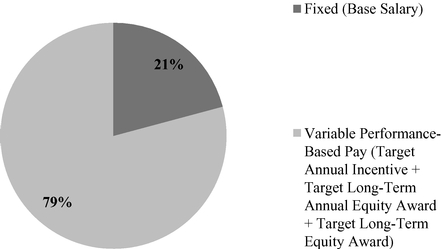

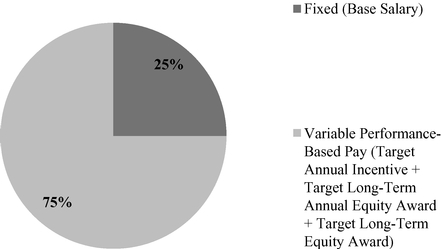

| | Mix of Target Total Direct Compensation | | | | | 3438 | | |

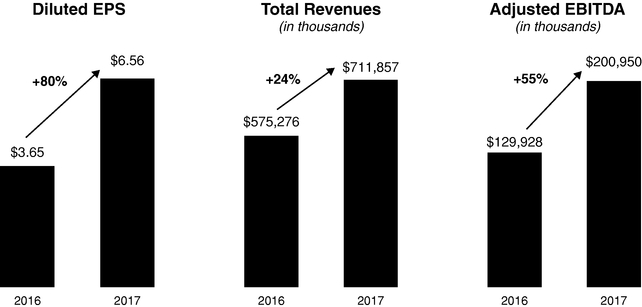

| | 20172022 Executive Officer Compensation

| | | | | 3539 | | |

| | | | | | | 4449 | | |

"Say on Pay" Results

| | | | |

Compensation Policies and Practices as theyAs They Relate to Risk Management | | | | | 4650 | | |

| | Compensation Committee Report | | | | | 4651 | | |

Reconciliation of Adjusted Income from Operations to GAAP Income from Operations

| | | | |

i

Table of Contents

| | | | |

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS | | | | | 4852 | | |

| | | | | | | 4852 | | |

| | Narrative Disclosures to Summary Compensation and Grants of Plan-Based Awards Tables | | | | | 5054 | | |

| | Employment and Separation Agreements | | | | | 5054 | | |

| | Management Deferred Stock Unit Purchase Plan (MSPP) | | | | | 5257 | | |

| | Potential Payments Uponupon Termination or a Change in Control | | | | | 5358 | | |

| | | | | | | 5661 | | |

Director Compensation

| | | | | | 5662 | | |

| | | | | | | 65 | | |

| | | | | | | 5867 | | |

| | Compensation Committee Interlocks and Insider Participation | | | | | 5967 | | |

| | Proposal 3: Advisory Resolution to Approve Executive Compensation | | | | | 5968 | | |

| | VOTING SECURITIES OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | | | 6069 | | |

Section 16(a) Beneficial Ownership Reporting Compliance

| | | | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | | | 6371 | | |

| | Related Party Transaction Policies | | | | | 6371 | | |

| | 2010 Registration Rights Agreement | | | | | 6371 | | |

Family Relationship

| | | | | | 6472 | | |

| | | | | | | 6573 | | |

| | Other Matters to Come Before the 20182023 Annual Meeting | | | | | 6573 | | |

| | Stockholder Proposals and Nominations for the 20192024 Annual Meeting | | | 65 | | 73 | | |

WALKER & DUNLOP, INC.

7501

7272 Wisconsin Avenue, Suite 1200E

1300

Bethesda, Maryland 20814 Why is this proxy statement being made available?

We have made this proxy statement available to you because you own shares of common stock of Walker & Dunlop, Inc. This proxy statement contains information related to the solicitation of proxies for use at our 20182023 annual meeting of stockholders, to be held at 10:00 a.m., Eastern Daylight Time, on Thursday, May 10, 20184, 2023 at the Hilton Garden Inn, 7301 Waverly Street, Bethesda, Maryland 20814, for the purposes stated in the accompanying Notice of Annual Meeting of Stockholders.

This solicitation is made by Walker & Dunlop, Inc. on behalf of our Board of Directors. Unless otherwise stated, as used in this proxy statement, the terms

"we," "our," "us"“we,” “our,” “us” and the

"Company"“Company” refer to Walker & Dunlop, Inc. The Notice of Internet Availability of Proxy Materials (the

"Notice“Notice of Internet

Availability"Availability”) is first being mailed to stockholders beginning on or about March

29, 2018.24, 2023.

Why did I receive a Notice of Internet Availability in the mail instead of a printed set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, or the SEC, we are permitted to furnish our proxy materials over the internet to our stockholders by delivering a Notice of Internet Availability in the mail. The Notice of Internet Availability instructs you on how to access and review the proxy statement and

20172022 Annual Report to Stockholders over the internet. The Notice of Internet Availability also instructs you on how you may submit your proxy over the internet. We believe that this e-proxy process expedites

stockholders'stockholders’ receipt of proxy materials, while also lowering our costs and reducing the environmental impact of our annual meeting.

If you received a Notice of Internet Availability in the mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting these materials provided in the Notice of Internet Availability.

What information is presented in this proxy statement?

The information contained in this proxy statement relates to the proposals to be voted on at the annual meeting of stockholders, the voting process, information about our Board of Directors and Board committees, the compensation of our directors and our executive officers for the fiscal year ended December 31,

2017,2022, and other required information.

Who is entitled to vote at the annual meeting?

Only holders of record of our common stock at the close of business on March

12, 2018,10, 2023, the record date for the annual meeting of stockholders, are entitled to receive notice of the annual meeting and to vote at the annual meeting. Our common stock constitutes the only class of securities entitled to vote at the meeting.

When you vote by following the instructions in the Notice of Internet Availability or, if you requested printed copies of the proxy materials, your proxy or voting instruction card, you appoint Richard M. Lucas and William M. Walker as your representatives to vote your

shares of common stock at the annual meeting. Messrs. Lucas and Walker, or either of them, will vote your

shares of common stock as you instruct. Accordingly, your

shares of common stock will be voted whether or not you attend the annual meeting. Even if you plan to attend the annual meeting, we encourage you to vote by following the instructions

Table of Contents

in the Notice of Internet Availability or, if you requested printed copies of the proxy materials, your proxy or voting instruction card, in advance.

Who can attend the annual meeting?

If you are a holder of our common stock at the close of business on March

12, 2018,10, 2023, the record date for the annual meeting, or a duly appointed proxy, you are authorized to attend the annual meeting. You will need to present proof of stock ownership and valid picture identification, such as a

driver'sdriver’s license or passport, before being admitted. If your common stock is held beneficially in the name of a bank, broker or other holder of record (i.e., street name), you must present proof of your ownership by presenting a bank or brokerage account statement reflecting your ownership as of the record date.

Cameras, recording equipment and other electronic devices will not be permitted at the annual meeting. For directions to the annual meeting of stockholders, contact Investor Relations at (301) 202-3207.

What will constitute a quorum at the annual meeting?

The presence at the annual meeting, in person or by proxy, of the holders of a majority of the common stock outstanding on March 10, 2023 will constitute a quorum, permitting the stockholders to conduct business at the annual meeting. We will include abstentions and broker non-votes in the calculation of the number of shares considered to be present at the annual meeting, including for purposes of determining the presence of a quorum at the meeting.

What are the voting rights of stockholders?

As of March

12, 2018,10, 2023, there were

30,913,28933,314,108 shares of common stock outstanding and entitled to vote at the annual meeting. Each share of common stock outstanding on the record date entitles its holder to cast one vote on each matter to be voted on.

If you hold your shares of common stock directly (i.e., not in a bank or brokerage account), you may vote by attending the meeting and voting in person or you may provide your proxy via the internet, telephone or mail in accordance with the instructions provided on the Notice of Internet Availability or, if you requested printed copies of the proxy materials, your proxy or voting instruction card.

If your shares of common stock are held in street name, you should follow the voting instructions provided to you by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee or, in most cases, submit voting instructions by the internet or by telephone to your broker or nominee. If you provide specific instructions, your broker or nominee

shouldwill vote your shares of common stock as directed. Additionally, if you want to vote in person and hold your shares in street name, you will need a

"legal proxy"“legal proxy” from your broker to vote at the annual meeting. Contact your broker or nominee for specific information on how to obtain a legal proxy in order to attend and vote your shares at the meeting.

What is a “broker non-vote”?

A broker non-vote occurs when shares held through a broker are voted on certain proposals but are not voted on other proposals because the broker (i) has not received voting instructions from the stockholder who beneficially owns the shares and (ii) lacks the authority to vote the shares at the broker’s discretion on such proposals. Under New York Stock Exchange rules, the election of directors (Proposal 1) and the advisory resolution to approve executive compensation (Proposal 3) are considered to be non-routine matters, and brokers will lack the authority to vote uninstructed shares at their discretion on such proposals. However, the ratification of our independent registered public accounting firm (Proposal 2) is a routine matter, so brokers may vote uninstructed shares at their discretion on Proposal 2. Accordingly, we do not expect any broker non-votes for Proposal 2.

If your vote is made in accordance with the instructions in the Notice of Availability or, if you requested printed copies of the proxy materials, your proxy or voting instruction card, and your vote is not revoked, the persons designated as proxy holders will vote the shares of common stock represented by that proxy as directed by you. If you return a signed proxy card but fail to indicate your voting preferences, the

persons designated as proxy holders will vote the shares of common stock represented by that proxy as recommended by the Board. The Board recommends a vote"FOR"“FOR” the election of alleach of the nominees for our Board of Directors named in this proxy statement (Proposal 1);"FOR"“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 20182023 fiscal year (Proposal 2); and"FOR"“FOR” the advisory resolution to approve executive compensation (Proposal 3).

Table of Contents

In the election of directors (Proposal 1), you may either vote"“FOR, ALL" the nominees” “AGAINST” or to"WITHHOLD" your vote“ABSTAIN” with respect to all, one or moreeach of the nominees. Regarding the ratification of our independent registered public accounting firm (Proposal 2), you may vote"“FOR," "AGAINST"” “AGAINST” or"“ABSTAIN."” Regarding the advisory resolution to approve executive compensation (Proposal 3), you may vote"“FOR," "AGAINST" or"ABSTAIN." If you withhold your vote with respect to any director nominee” “AGAINST” or abstain from voting on the ratification“ABSTAIN.” For each of our independent registered public accounting firm, or advisory resolution to approve executive compensation, your shares of common stock will be counted as present, including for purposes of establishing a quorum. AbstentionsProposals 1, 2 and 3, abstentions and broker non-votes will not count as votes cast for a proposal and will have no effect on the result of the vote on any proposal.

Will my shares of common stock be voted if I do not provide my proxy and I do not attend the annual meeting?

If you are a stockholder of record and you do not cast your vote, votes will not be cast on your behalf on any of the items of business at the annual meeting.

If you hold your shares in street name it is critical that you cast your vote if you want it to count in the election of directors (Proposal 1)

and the advisory vote on executive compensation (Proposal 3). Under applicable rules, the bank or broker that holds your shares does not have the ability to vote your uninstructed shares

in the election of directorson Proposals 1 or 3 on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your bank or broker how to vote

in the election of directors,on Proposals 1 or 3, votes will not be cast on your behalf. Your bank or broker will, however, have discretion to vote any uninstructed shares on the ratification of the appointment of our independent registered public accounting firm (Proposal 2).

TheyIf you are a stockholder of record and you do not cast your vote, votes will not

have discretion to vote uninstructed sharesbe cast on

your behalf on any of the

advisory resolution to approve executive compensation (Proposal 3).items of business at the annual meeting.

Yes. You may change or revoke a previously granted proxy at any time before it is exercised by either (i) submitting a later-dated proxy,

in person at the annual meeting or by mail, or (ii) delivering

instructionsa written request to our Secretary at our principal executive offices located at

75017272 Wisconsin Avenue, Suite

1200E,1300, Bethesda, Maryland

20814.20814 that revokes your previously granted proxy or (iii) attending the annual meeting and voting in person. Please note that attendance at the

annual meeting will not, in

and of itself, constitute revocation of a previously granted proxy.

If your shares of common stock are held in street name, then you may submit new voting instructions by contacting your broker or nominee. You may also vote in person at the annual meeting if you obtain a legal proxy from your broker as described above.

What will constitute a quorum at the annual meeting?

The presence Please note that attendance at the annual meeting will not, in person or by proxy,and of the holdersitself, constitute revocation of a majority of the common stock outstanding on March 12, 2018 will constitute a quorum, permitting the stockholders to conduct business at the annual meeting. We will include abstentions and broker non-votes in the calculation of the number of shares considered to be present at the annual meeting, including for purposes of determining the presence of a quorum at the meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares.

previously granted proxy.

How many votes are needed to approve each of the proposals?

Directors are

A nominee for director shall be elected by a plurality of the votes cast. Therefore, the eight nominees for election to the Board of Directors (Proposal 1) if such nominee receives the affirmative vote of a majority of the total votes cast. If a nominee who is an incumbent director does not receive the mostaffirmative vote of a majority of the total votes cast, the director shall offer his or her resignation to the Board of Directors and the Board will be elected (Proposal 1). consider whether to accept or reject the director’s offer to resign. Abstentions and broker non-votes will not count as votes cast and will have no effect on the result of the vote on Proposal 1.

Will any other matters be voted on?

As of the date of this proxy statement, we do not know of any matters that will be presented for consideration at the annual meeting other than those matters discussed in this proxy statement. If any other matters properly come before the annual meeting and call for a stockholder vote, valid proxies will be

voted by the holders of the proxies in accordance with the recommendation of the Board or, if no recommendation is given, in their own discretion.

Who is soliciting my proxy?

This solicitation of proxies is made by and on behalf of our Board of Directors. We will pay the costs of soliciting proxies,

which will consist primarily ofincluding the cost of printing, postage and handling. In addition to soliciting proxies by mail, our officers, directors and other employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, custodians and nominees will forward proxy soliciting materials to their principals, and that we will reimburse these

persons'persons’ out-of-pocket expenses.

Is there a list of stockholders entitled to vote at the annual meeting?

The names of stockholders of record entitled to vote at the annual meeting will be available

at the annual meeting and for ten days prior to the annual meeting, between the hours of 9:00 a.m. and 4:30 p.m., at our principal executive offices at

75017272 Wisconsin Avenue, Suite

1200E,1300, Bethesda, Maryland 20814, by contacting the Secretary.

How can I obtain a copy of the 20172022 Annual Report and the Annual Report on Form 10-K for the year ended December 31, 2017?

2022?

You may access, read and print copies of the proxy materials for this

year'syear’s annual meeting, including our proxy statement, form of proxy card, and annual report to stockholders, at the following Web address: http://www.edocumentview.com/WD.

We file annual, quarterly and current reports; proxy statements; and other information with the SEC. You may read and copy any reports, statements or other information we file with the Securities & Exchange Commission ("SEC"(“SEC”) on the website maintained by the SEC at www.sec.gov. At the written request of any stockholder who owns common stock as of the close of business on the record date, we will provide, without charge, paper copies of our Annual Report on Form 10-K, including the financial statements and financial statement schedule, as filed with the SEC, except exhibits thereto. If requested by eligible stockholders, we will provide copies of the exhibits for a reasonable fee.You can request a copy of our Annual Report on Form 10-K, free of charge, by following the instructions on the Notice of Internet Availability or by mailing a written request to: Walker & Dunlop, Inc., Attention: Investor Relations, 75017272 Wisconsin Avenue, Suite 1200E,1300, Bethesda, Maryland 20814. You should rely only on the information provided in this proxy statement. We have not authorized anyone to provide you with different information. You should assume that the information in this proxy statement is accurate only as of the date of this proxy statement, or, where information relates to another date set forth in this proxy statement, then as of that date.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Proposal 1: Election of Directors for a One-Year Term Expiring at the

20192024 Annual Meeting of Stockholders

Our Board of Directors, or the Board, is currently comprised of eight directors, each with terms expiring at the

20182023 annual meeting. Our Nominating and Corporate Governance Committee has recommended to our Board the eight nominees set forth below, all of whom are currently serving as directors of the Company, for re-election to serve as directors for one-year terms until the

20192024 annual meeting and until their successors are duly elected and qualified. Following the Nominating and Corporate Governance

Committee'sCommittee’s recommendation, our Board has nominated those persons set forth below.

Based on its review of the relationships between the director nominees and the Company, and as discussed in greater detail below, the Board has affirmatively determined that, if these nominees are elected, the following six directors are

"independent"“independent” directors under the rules of the New York Stock Exchange, or NYSE:

Alan J. Bowers, Cynthia A. Hallenbeck,Ellen D. Levy, Michael D. Malone, John Rice, Dana L. Schmaltz,

and Michael J.

Warren.Warren and Donna C. Wells.

The Board knows of no reason why any nominee would be unable to serve as a director. If any nominee is unavailable for election or service, the Board may designate a substitute nominee and the persons designated as proxy holders on the proxy card will vote

foron the substitute nominee recommended by the Board, or the Board may, as permitted by our bylaws, decrease the size of our Board.

A nominee for director shall be elected to the Board of Directors (Proposal 1) if such nominee receives the affirmative vote of a

pluralitymajority of

all the

total votes

atcast as to such nominee. If a nominee who is an incumbent director does not receive the

annual meeting is necessary for the electionaffirmative vote of a

director. Accordingly,majority of the

eight individuals withtotal votes cast as to such nominee, the

highest numberdirector shall offer his or her resignation to the Board of

affirmative votesDirectors, and the Board will

be elected as directors.consider whether to accept or reject the director’s offer to resign. Cumulative voting in the election of directors is not permitted. For purposes of the election of directors,

shares that are withheldabstentions and

other shares not voted (whether by broker

non-vote or otherwise)non-votes will not be counted as votes cast, and will have no effect on the result of the vote.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE

"FOR"“FOR” EACH OF THE NOMINEES SET FORTH BELOW.

Nominees for Election for a One-Year Term Expiring at the 20192024 Annual Meeting of Stockholders

The following table sets forth the name and age of each nominee for director, indicating all positions and offices with us currently held by the director.

| Name | | | Age | | | Title | |

Name

| | Age | | Title |

|---|

William M. Walker | | | 50 | | 55 | | | | Chairman of the Board of Directors and Chief Executive Officer | |

Howard W. Smith, III | | | 59 | | 64 | | | | President and Director | |

Alan J. Bowers

Ellen D. Levy | | | 63 | | Lead 53 | | | | Director | |

Cynthia A. Hallenbeck

Michael D. Malone | | | | | 69 | | | | Director | |

| John Rice | | | | | 56 | | | | Director | |

| Dana L. Schmaltz | | | | | 56 | | | | Director | |

| Michael J. Warren | | | | | 55 | | | | Director | |

| Donna C. Wells | | | | | 61 | | Director |

Michael D. Malone

| | Director | 64 | | Director |

John Rice

| | | 51 | | Director |

Dana L. Schmaltz

| | | 51 | | Director |

Michael J. Warren

| | | 50 | | Director |

Table of Contents

Set forth below are descriptions of the backgrounds and principal occupations of each of our nominees for director, and the period during which he or she has served as a director.

William M. Walker is our chairman Also set forth below are specific experience, qualifications, skills and chief executive officer. attributes that supported the Board’s determination to nominate the director for re-election.

| | | | | William M. Walker

Chairman and Chief Executive Officer, Walker & Dunlop, Inc. Committees: None; member of management EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership, strategic planning and commercial real estate experience as chairman and chief executive officer of Walker & Dunlop •

Affiliation with leading commercial real estate policy associations •

Previous outside board experience | |

Mr. Walker has been a member of our Board since July 2010 and a board member of Walker & Dunlop, LLC, our operating company, or its predecessors since February 2000. In September 2003, Mr. Walker became the executive vice president and chief operating officer of Walker & Dunlop and served as the president of Walker & Dunlop from January 2005 to April 2015, and has served as the chief executive officer since January 2007. Mr. Walker currently serves on the boards of the

Children's National

Medical Center,Multifamily Housing Council and the

Federal City Council, Mortgage Bankers Association, Blue Drop, LLCUnited States Olympic and

on the board of trusteesParalympic Committee Foundation, and also is a member of the

St. Albans School at the National Cathedral. Mr. Walker served as chairman of the board of directors of the District of Columbia Water and Sewer Authority from 2008 until 2012. He also served on the board of directors of Transcom Worldwide S.A., a publicly traded European outsourcing company, from 2004 to 2006 and served as its chairman of the board from 2006 to January 2012.Real Estate Round Table. Mr. Walker received his Bachelor of Arts in Government from St. Lawrence University and his

Master'sMaster’s in Business Administration from Harvard University.

Mr. Walker brings to our Board more than 20 years of leadership experience. Mr. Walker possesses in-depth knowledge of our industry, offers valuable insight into our business and provides the leadership, general management and vision that help us compete successfully.

Howard W. Smith, III is our president and one of our directors.

| | | | | Howard W. Smith, III.

President, Walker & Dunlop, Inc. Committees: None; member of management EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership, strategic planning and commercial real estate experience as president of Walker & Dunlop and previous distinguished service as a senior loan originator at the Company for over 40 years •

Affiliation with leading commercial real estate policy associations | |

Mr. Smith has been a member of our Board since July 2010, and previously served as our executive vice president & chief operating officer from July 2010 to April 2015, when he was promoted to president.

Mr. Smith joined Walker & Dunlop in November 1980 and has been a member of the management team since 1988. Mr. Smith served as Walker & Dunlop,

LLC'sLLC’s executive vice president & chief operating officer from 2004 to April 2015, when he was promoted to president. He also has served as a board member of Walker & Dunlop, LLC or its predecessors since 2004. As president, Mr. Smith is responsible for our Multifamily, FHA Finance, Capital Markets and

InvestmentProperty Sales groups. Mr. Smith is a member of the board of directors of the National

MultiMultifamily Housing

Council and a member of the board of advisors to the Williams School of Commerce, Economics and Politics at Washington and Lee University. He also served as the chairman of the Fannie Mae DUS Peer Group advisory council from 2007 to 2008 and again from 2009 to 2010.Council. Mr. Smith received his Bachelor of Arts in Economics from Washington & Lee University.

Mr. Smith brings to our Board more than 30 years of experience in the commercial real estate finance industry. He has extensive knowledge of our operations, having spent his entire career at Walker & Dunlop. In his capacity as president, Mr. Smith also provides our Board with management's perspective on our business operations and conditions, which is crucial to our Board's performance of its oversight function.

Alan J. Bowers is one of our directors and serves on the Audit Committee (Chairman) and the Nominating and Corporate Governance Committee, and is our Lead Director. Mr. Bowers

| | | | | Ellen D. Levy, Ph.D.

Managing Director, Silicon Valley Connect, LLC, a management consulting firm Committees:![[MISSING IMAGE: ic_compen-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_compen-bwlr.jpg) Compensation Compensation![[MISSING IMAGE: ic_nomina-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_nomina-bwlr.jpg) Nominating & Corporate Governance Nominating & Corporate Governance EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership and strategic planning and technology experience as vice president of strategic investments at LinkedIn Corporation •

Public company board experience | |

Dr. Levy has been a member of our Board since

December 2010. Mr. Bowers currentlyMarch 2019. Dr. Levy serves

on the board and as

audit committee chairmanmanaging director of

La Quinta Inns & Suites,Silicon Valley Connect, LLC, a

publicly traded hotel chain. Mr. Bowers also serves on the board of Ocwen Financialmanagement consulting company she founded. From 2008 to April 2012, Dr. Levy served in various roles at LinkedIn Corporation, a

publicly traded residential mortgage lending and servicing company, where he is chairmanprofessional social networking internet service, including as its vice president of

the audit committee and member of the risk and compliance committee. Prior to Mr. Bowers' retirement in 2005, Mr. Bowers was the president and chief executive officer and a board member of Cape Success, LLC, a private equity-backed staffing service and information technology solutions business,strategic initiatives from

2001 to 2004. Mr. Bowers was also the president and chief executive officer and a board member of MarketSource Corporation, a marketing and sales support service firm, from 2000 to 2001, and of MBL Life Assurance Corporation, a life insurance firm, from 1995 to 1999. Mr. Bowers previously served on the board of Quadel Consulting

Table of Contents

Corp., a privately held government contract manager and consulting firm (from July 2005 to June 2015) and on the boards and as audit committee chairman of American Achievement Corp., a privately held manufacturer and distributer of graduation products (from August 2006 to March 2016); Refrigerated Holdings, Inc., a temperature controlled logistics firm (from January 2009 to April 2013); Roadlink Inc., a trucking and logistics firm (from February 2010 to April 2013); and Fastfrate Holdings, Inc., a Canadian trucking and logistics firm (from July 2008 to June 2011), each a privately held company. Mr. Bowers has been a certified public accountant since 1978 and served as staff auditor, audit partner and managing partner, serving a diverse client base during his tenure at Coopers & Lybrand, L.L.P. from 1978 to 1995 and a staff accountant with Laventhol & Horwath, CPAs from 1976 to 1978. Mr. Bowers earned his Master's in business administration from St. John's University and his Bachelor of Science in accounting from Montclair State University.

Mr. Bowers brings to our Board over 30 years of experience in accounting and executive management, including experience on the audit committees of private companies and SEC registrants. Mr. Bowers' accounting expertise and diverse corporate management experience are assets to our Board.

Cynthia A. Hallenbeck2012. Dr. Levy is one of our directors and serves on the Audit Committee and Compensation Committee. Ms. Hallenbeck has been a member of our Board since December 2010. Ms. Hallenbeck is the chief executive officer of Alercyn, Inc., a private consulting firm that she founded in 2010, where her most significant engagement was as the acting chief financial and administrative officer of the Council for Economic Education. She previously served as Environmental Defense Fund's ("EDF") chief financial officer and treasurer from January 2014 to June 2016. Prior to joining EDF, Ms. Hallenbeck served as the vice president of finance and operations of the Arcus Foundation from January 2012 to October 2012. Prior to founding Alercyn, Inc., Ms. Hallenbeck worked at Citigroup, Inc. from 2002 to 2008, where she served in a number of divisions in various capacities, including as chief financial officer of Citigroup's corporate treasury department from 2002 to 2005, an internal consultant for Citigroup's office of the chief administrative officer from 2006 to 2007 and chief operating officer of global legal support from 2007 to 2008. Prior to her service with Citigroup, Ms. Hallenbeck spent over 14 years at Merrill Lynch & Co., Inc. in a variety of finance, treasury and accounting roles including treasurer of its global futures business and chief financial officer of its securities financing group. Ms. Hallenbeck also worked with GTE Corporation (currently Verizon Communications, Inc.), a telecommunications company, from 1985 to 1987, where she served as a manager in its financial strategies division, and also with Manufacturers Hanover Trust, a banking institution, from 1979 to 1983, where she served as assistant vice president and a thrift industry specialist. Ms. Hallenbeck has served on the audit committee of the Clinton Health Access Initiative since September 2013. Ms. Hallenbeck wascurrently a member of the board of the non-profit Global HIV Vaccine Enterprisedirectors of Learn CW Investment Corporation, a blank check company, and Healthwell Acquisition Corp. I, a special acquisition company. From 2015 to 2020, Dr. Levy served as its treasurer, from January 2009 to September 2012. Ms. Hallenbecka member of the board of directors of Instructure, Inc., a publicly traded educational technology company. Dr. Levy received her Bachelor of ArtsScience from the University of Michigan and a Master’s and Doctorate in economicscognitive psychology from Smith College and her Master's in Business Administration from HarvardStanford University.

Ms. Hallenbeck brings to our Board over 30 years of experience in financial management and accounting, including extensive management experience on the executive management teams of several private and public companies and service on the audit committees of several organizations. Ms. Hallenbeck's accounting expertise and management experience are assets to our Board.

Michael D. Malone is one of our directors and serves on our Audit Committee and Compensation Committee (Chairman).

| | | | | Michael D. Malone

Retired Managing Director, Fortress Investment Group LLC, a global private equity firm Committees:![[MISSING IMAGE: ic_audit-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_audit-bwlr.jpg) Audit; Audit;![[MISSING IMAGE: ic_compen-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_compen-bwlr.jpg) Compensation (chair) Compensation (chair) EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership and strategic planning experience as managing director of Fortress Investment Group LLC •

Investment banking experience at Banc of America Securities •

Public company board experience | |

Mr. Malone has been a member of our Board since November 2012.

Since February 2012, Mr. Malone has been a member of the board of directors of Nationstar Mortgage Holdings Inc., a publicly traded non-bank residential mortgage servicer, a global alternative investment and asset management firm, where he is the chairman of the nominating and corporate governance committee and is a member of its audit and compensation committees. Since October 2014, Mr. Malone has been a member of the board of directors of New Senior Investment Group Inc. ("New

Table of Contents

Senior"), a publicly traded externally managed real estate investment trust that is primarily focused on investing in senior housing properties, where he is the chairman of the nominating and corporate governance committee and is a member of its audit committee. From February 2008 to February 2012, Mr. Malone served as managing director of Fortress Investment Group LLC, where he was in charge of the Charlotte, North Carolina office and responsible for the business of the capital formation group in the southeast and southwest regions of the United States. From 2008 to 2013, Mr. Malone served as a member of the board of directors and audit committee, and was co-chairman of the compensation committee of Morgans Hotel Group Co., a publicly traded company that operated, owned, acquired, developed and redeveloped boutique hotels. Mr. Malone retired from Bank of America in November 2007, after nearly 24 years of service as a senior executive banker and managing director. Over those years, Mr. Malone worked in and ran a number of investment banking businesses for the bank and its subsidiary, Banc of America Securities, including real estate, gaming, lodging, leisure, and the financial sponsors businesses. Mr. Malone is lead director and member of the board of directors of Mr. Cooper Group Inc., a publicly traded non-bank residential mortgage lender, where he is the nominating and corporate governance committee chairman and a member of the audit and compensation committees. From 2014 to 2021, Mr. Malone served on the board of directors of New Senior Investment Group Inc., a publicly traded

internally managed real estate investment trust. Mr. Malone received his Bachelor of Science in General Studies from the University of Kentucky.

Mr. Malone's extensive experience and expertise in the financial and real estate industries enable him to provide valuable insight into our commercial real estate lending business operations and our strategic direction.

John Rice is one of our directors and serves on the Compensation Committee and the Nominating and Corporate Governance Committee (Chairman), and served as our Lead Director from September 2010 to June 2012.

| | | | | John Rice

Chief Executive Officer, Management Leadership for Tomorrow, a national non-profit organization Committees: ![[MISSING IMAGE: ic_compen-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_compen-bwlr.jpg) Compensation; Compensation;![[MISSING IMAGE: ic_nomina-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_nomina-bwlr.jpg) Nominating & Corporate Governance (chair) Nominating & Corporate Governance (chair) EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership and strategic planning experience as CEO of Management Leadership for Tomorrow and previously as managing director of NBA Japan, an affiliate of the National Basketball Association •

Marketing experience as director of marketing for Latin America for the National Basketball Association •

Public company board experience | |

Mr. Rice has been a member of our Board since July 2010 and served as

a board member of Walker & Dunlop, LLCour Lead Director from

JanuarySeptember 2010 to

December 2010.June 2012. Mr. Rice

serves asis the chief executive officer of Management Leadership for Tomorrow, a national non-profit organization that he founded in 2001. Management Leadership for Tomorrow equips under-represented minorities with the skills, coaching and relationships that unlock their potential as senior business and community leaders. Prior to Management Leadership for Tomorrow, Mr. Rice was an executive with the National Basketball Association from 1996 to 2000, where he served as managing director of NBA Japan and as director of marketing for Latin America. Before joining the National Basketball Association, Mr. Rice spent four years with the Walt Disney Company in new business development and marketing, and two years with AT&T. Mr. Rice is

a member of the board of directors and lead director of Opendoor Technologies Inc., a publicly traded digital platform for residential real estate, where he serves as a member of the nominating and corporate governance committee. He also

is a

trusteemember of

the board of directors of Alpha Partners Technology Merger Corp., a publicly traded blank check company where he is a member of the audit, nominating, and compensation committees. Mr. Rice also serves on the board of directors of Morgan Stanley Real Estate’s Prime Property Fund, a private fund. Mr. Rice is a member of the Yale University

board of trustees and serves on the boards of several non-profits including

the Woodrow Wilson Fellowship Foundation and New

Profit.Profit, a venture philanthropy fund. Mr. Rice received his Bachelor of Arts from Yale University and his

Master'sMaster’s in Business Administration from Harvard University.

Mr. Rice's success with his various entrepreneurial ventures, as well as his many years of marketing and talent development experience, provide our Board with valuable business and marketing insights. Additionally, Mr. Rice's leadership in the non-profit sector is consistent with our commitment to community service.

Dana L. Schmaltz is one of our directors and serves on the Compensation Committee and the Nominating and Corporate Governance Committee.

| | | | | Dana L. Schmaltz

Founder and Partner, Yellow Wood Partners, LLC, a private equity firm focused on the consumer products industry Committees:![[MISSING IMAGE: ic_compen-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_compen-bwlr.jpg) Compensation; Compensation;![[MISSING IMAGE: ic_nomina-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_nomina-bwlr.jpg) Nominating & Corporate Governance Nominating & Corporate Governance EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership and strategic planning experience as founder and partner at Yellow Wood Partners, LLC •

Experience acquiring and operating several portfolio companies in various roles •

Chief financial officer experience at Blacksmith Brands, Inc. | |

Mr. Schmaltz has been a member of our Board since December 2010. Mr. Schmaltz is currently a partner at Yellow Wood Partners, LLC, a private equity firm he founded, which is focused on the consumer products industry. Mr. Schmaltz was the co-founder, director and chief financial officer of Blacksmith Brands, Inc., a privately owned consumer products company that was created in September 2009. As the co-founder and a senior manager of Blacksmith Brands, Mr. Schmaltz was responsible for overseeing the

operations of the business with the senior management team, as well as for developing future acquisition opportunities for the company. Prior to founding Blacksmith Brands, Mr. Schmaltz was a managing partner of West Hill Partners, LLC, a Boston-based private equity firm, from 2007 to 2009. Prior to that, Mr. Schmaltz was the president of J.W. Childs Associates, LP, a private equity fund, where he focused on investments in the consumer/specialty retail

sector. Mr. Schmaltz was a generalsector, and served as partner

atof J.W. Childs from 1997 to 2007.

He has also been a director of Mattress Firm, Inc. from January to June 2007, Fitness Quest, Inc.

Table of Contents

from 2004 to 2007, Esselte, AB from 2002 to 2007 and NutraSweet from 2000 to 2007. Mr. Schmaltz began his career in the private equity industry at the NTC Group in 1991 and has held various positions at Kidder, Peabody, Inc. and Drexel Burnham Lambert. Mr. Schmaltz received his Bachelor of Arts in History from Dartmouth College and his Master'sMaster’s in Business Administration from Harvard University.

Mr. Schmaltz brings to our Board over 25 years of experience in private equity investments, executive management and financial advisory services. Mr. Schmaltz contributes his investment and management experience to our Board's oversight of business development opportunities and integration of acquired businesses into the Company.

Michael J. Warren is one of our directors and serves on the Nominating and Corporate Governance Committee.

| | | | | Michael J. Warren

Global Managing Director, Albright Stonebridge Group, a global strategic advisory and commercial diplomacy firm Committees:![[MISSING IMAGE: ic_audit-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_audit-bwlr.jpg) Audit Audit EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership and strategic planning experience as the global managing director of Albright Stonebridge Group •

U.S. Government service (as former senior advisor to the White House Presidential Personnel Office and service in the Office of the Secretary of the U.S. Department of Labor) •

Chief financial officer experience at Stonebridge International •

Public company board experience | |

Mr. Warren has been a member of our Board since February 2017. Mr. Warren is the

Global Managing Directorglobal managing director of Albright Stonebridge Group

("ASG"(“ASG”)

., part of the Dentons Global Advisor. He served as

ASG's Managing PartnerASG’s managing principal from 2013 to 2017 and as

its Partnerprincipal from 2009 to 2013. Prior to ASG, he served as the

Chief Operating Officerchief operating officer and

Chief Financial Officerchief financial officer of Stonebridge International from 2004 to 2009, where he managed operations, business development, finance and personnel

portfolios before leading the firm's merger with The Albright Group.portfolios. Mr. Warren

has served in various capacities in the Obama Administration, including as

Senior Advisor, Treasury and Economic Agenciessenior advisor of the White House Presidential Personnel Office and as

Co-Lead,co-lead for the Treasury and Federal Reserve

Agency Review Teamsagency review teams of the Obama-Biden Presidential Transition.

He alsoMr. Warren is a member of the board of directors of Maximus, Inc., a publicly traded operator of government, health and human services programs, where he serves as

Chairmana member of the

Boardcompensation, nominating and

Trusteecorporate governance and technology committees. Mr. Warren is also a member of the board of directors of Brookfield Business Corporation, a publicly traded owner of global healthcare, construction and infrastructure services and industrial firms and serves as a member of the board of directors of Ripple Labs, a privately held company that is a leader in enterprise blockchain and crypto solutions. From 2020 to 2021, Mr. Warren served on the board of directors of Decarbonization Plus Acquisition Corporation, Brookfield Property REIT Inc. and Brookfield Property Partners L.P. In 2021, Mr. Warren served on the boards of Decarbonization Plus Acquisition Corporation II and Decarbonization Plus Acquisition Corporation III. He serves as a member of the board of trustees and of the risk and audit committees of Commonfund and as a trustee of Yale University and is a member of the Yale Corporation investment committee. Mr. Warren formerly served as a member of the board of directors of the Overseas Private Investment Corporation (“OPIC”) and as a trustee of the District of Columbia Retirement Board

Chairman of the Audit Committee of the Overseas Private Investment Corporation, a member of the Board of Trustees and of the Risk and Audit Committees of Commonfund, and as a member of the Yale University Council and Yale School of Management Board of Advisors. He holds Bachelor of Arts(“DCRB”). Mr. Warren received degrees from Yale University and Balliol College

at Oxford University

of Oxford, where he was a Rhodes Scholar.

Mr. Warren's extensive

| | | | | Donna C. Wells

Chief Executive Officer, Valencia Ventures, LLC a strategic consulting and corporate governance firm Committees:![[MISSING IMAGE: ic_compen-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_compen-bwlr.jpg) Audit (chair); Audit (chair);![[MISSING IMAGE: ic_nomina-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-23-033585/ic_nomina-bwlr.jpg) Nominating & Corporate Governance Nominating & Corporate Governance EXPERIENCES, QUALIFICATIONS, SKILLS & ATTRIBUTES •

Executive leadership and strategic planning experience as president and chief executive officer of Mindflash Technologies •

Chief marketing officer experience at Mint Software, Inc., and marketing leadership responsibilities at Intuit and Expedia •

Public company board experience | |

Ms. Wells has been a member of our Board since March 2021. Ms. Wells is chief executive

leadership and board experience with financial institutions as well as hisofficer of Valencia Ventures, LLC, a strategic consulting

experience enhances our Board's overalland corporate governance firm which she founded. From 2010-2017, Ms. Wells served as President and Chief Executive Officer of Mindflash Technologies, Inc., an innovative, venture-backed enterprise software company that provided a cloud-based training platform for businesses. From 2007-2009, Ms. Wells was Chief Marketing Officer at Mint Software, Inc. (“Mint”) where she led the growth strategy for this mobile personal finance software company from product launch to the company’s acquisition by Intuit. Prior to Mint, Ms. Wells led US marketing for Intuit and the Expedia Group, roles which drew on her 20 years of experience in

overseeing our corporate strategystrategic consumer and

efficiency initiatives,product marketing with leading brands including

The American Express Company and The Charles Schwab Corporation. Ms. Wells is a member of the

board of directors of Mitek Systems, Inc., a publicly traded software development

company, where she is the chair of

an assetthe nominating and governance committee and has served as a member of the audit and compensation committees. Ms. Wells was previously a director and risk committee member at Boston Private Financial Holdings, Inc., a publicly traded bank holding company from 2014 to 2018, and a director and audit committee member at Apex Technology Acquisition Corporation, a publicly traded special acquisition company, from 2019 to 2021. She also serves on the boards of two private companies: CWT Travel Holdings, Inc., a global business travel management

business.platform, where she is a member of the audit and finance committee and nominating and ESG committee, and Betterment Holdings, Inc., a leading independent digital wealth management platform with over $35 billion in AUM, where she is a member of the audit committee. In September 2019, Ms. Wells was appointed by the Center for Entrepreneurial Studies at the Stanford University Graduate School of Business as a Lecturer in Management. She holds a Bachelor of Science in Economics from The Wharton School at the University of Pennsylvania and a Master’s in Business Administration from Stanford University.

Corporate Governance Information

We are committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders well and maintaining our integrity in the marketplace. Accordingly, our Board has adopted and maintains the following corporate governance guidelines, codes and charters:

•

Corporate Governance Guidelines;

•

Code of Business Conduct and Ethics;

•

Code of Ethics for Principal Executive Officer and Senior Financial Officers;

•

Charter of the Audit Committee of the Board of Directors;

•

Charter of the Compensation Committee of the Board of Directors; and

•

Charter of the Nominating and Corporate Governance Committee of the Board of

Directors.Directors; and

•

Complaint Procedures for Accounting and Auditing Matters.

From time to time, we may revise the above-mentioned corporate governance guidelines, codes and charters in response to changing regulatory requirements, evolving best practices and the concerns of our stockholders and other constituents. Please visit our website at www.walkerdunlop.com to view

Table of Contents

or obtain a

copy of the current version of any of these documents. We will provide any of the above-mentioned documents, free of charge, to any stockholder who sends a written request to:

Walker & Dunlop, Inc.

Attn: Investor Relations

7501

7272 Wisconsin Avenue, Suite

1200E1300

Bethesda, Maryland 20814

References to our website address throughout this proxy statement are for informational purposes only, or to fulfill specific disclosure requirements of the SEC’s rules. These references are not intended to, and do not, incorporate the contents of our website by reference into this proxy statement.

Our bylaws and Corporate Governance Guidelines conform to the NYSE rules, which require us to have a majority of independent board members and a nominating/corporate governance committee, compensation committee and audit committee, each comprised solely of independent directors. Under the NYSE listing standards, no director of a company qualifies as

"independent"“independent” unless the board of directors of the company affirmatively determines that the director has no material relationship with the company (either directly or as a partner, stockholder or officer of an organization that has a relationship with such company). In addition, the NYSE listing standards contain the following further restrictions upon a listed

company'scompany’s director independence:

•

a director who is an employee, or whose immediate family member is an executive officer, of the listed company is not independent until three years after the end of such employment relationship;

•

a director who has received, or has an immediate family member who has received, during any twelve-month12-month period within the last three years, more than $120,000 in direct compensation from the listed company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), is not independent;

•

a director who is, or whose immediate family member is, a current partner of a firm that is the company'scompany’s internal or external auditor is not independent; a director who is a current employee of such a firm is not independent; a director who has an immediate family member who is a current employee of such a firm and personally works on the company'scompany’s audit is not independent; and a director who was, or whose immediate family member was, within the last three years a partner or employee of such a firm and personally worked on the company'scompany’s audit within that time is not independent;

•

a director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of the listed company'scompany’s present executive officers at the same time serve or served on the other company'scompany’s compensation committee is not independent until three years after the end of such service or the employment relationship; and

•

a director who is an executive officer or an employee, or whose immediate family member is an executive officer, of another company that has made payments to, or received payments from, the listed company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other

company'scompany’s consolidated gross revenues, is not independent.

To adequately assess and ensure that (i) at least a majority of our directors qualify as independent and (ii) each of the Board committees is comprised of solely independent directors, the Board assesses annually the independence of all directors and director nominees. In accordance with the independence criteria established by the Board from time to time, our Board considers all relevant facts and circumstances in order to make an affirmative determination as to whether any director has a direct or indirect material relationship to the Company. In assessing the materiality of a

director'sdirector’s or

nominee'snominee’s relationship with the Company, the Board considers the issues from the

director'sdirector’s or

nominee's

Table of Contents

nominee’s standpoint and from the perspective of the persons or organization with which the director or nominee has an affiliation. Our Board has evaluated the status of each current director, and has affirmatively determined, after considering the relevant facts and

circumstances and the independence standards set forth above, that each of Alan J. Bowers, Cynthia A. Hallenbeck,Ellen D. Levy, Michael D. Malone, John Rice, Dana L. Schmaltz, and Michael J. Warren and Donna C. Wells is independent, as defined in the NYSE rules, and that none of these directors hashave a material relationship with us. In conducting itsevaluating Mr. Rice’s independence, determination of Mr. Malone, the Board considered the Company'spayment in 2022 of $85,000 by us to Management Leadership for Tomorrow (or MLT), a not-for-profit entity of which Mr. Rice serves as chief executive officer, for employee placement and recruiting services and in connection with obtaining

MLT Black Equity at Work and Hispanic Equity at Work Certifications. MLT had 2022 gross receipts in excess of $30 million. MLT, which was founded by Mr. Rice in 2001, has a mission to equip under-represented minorities with the skills, coaching and relationships that unlock their potential as senior business and community leaders. In evaluating Mr. Warren’s independence, the Board considered the Company’s immaterial indirect business relationship with New Senior,Brookfield Business Corporation on whose board Mr. MaloneWarren is a member. Specifically, the Board evaluated Mr. Malone'sWarren’s independence in light of financing transactions containing customary termsa lending and conditions onloan servicing relationship with Brookfield Properties, an affiliate of Brookfield Business Corporation. The Board considered two portfolios of loans made in 2015 made2022 by Walker & Dunlop, LLC to Brookfield Properties with an affiliateaggregate principal amount of New Senior. No transactions with New Senior occurred$151 million, and five loans serviced in 2016 or 2017.2022 on properties owned by Brookfield Properties, for which the Company received immaterial 2022 aggregate lending and loan servicing fees. The Board has determined that the 2015 financing transactions did not impair Mr. Malone's independence. Board Leadership Structure Mr. Walker serves as the

Company'sCompany’s Chairman and Chief Executive Officer. The Board has determined that combining the Chairman and Chief Executive Officer positions is the appropriate leadership structure for the Company and believes that combining the Chairman and Chief Executive Officer roles fosters clear accountability, effective decision-making and alignment on corporate strategy.

Nevertheless, the Board understands that the structure of the Board must encourage the free and open dialogue of competing views and provide for strong checks and balances. Specifically, an effective governance structure must balance the powers of the Chief Executive Officer and the independent directors and ensure that the independent directors are fully informed, able to discuss and debate the issues that they deem important, and able to provide effective oversight of management.

The Board is committed to maintaining a

"Lead Director,"“Lead Director” as a matter of good corporate governance. The Lead Director is an independent director consistent with criteria established by the NYSE and will be selected on an annual basis by a majority of the independent directors then serving on the Board. The role of the Lead Director is to serve as liaison between (i) the Board and management, including the Chief Executive Officer, (ii) independent directors and (iii) interested third parties and the Board. The Lead Director serves as the focal point of communication to the Board regarding management plans and initiatives, and ensures that the role between board oversight and management operations is respected. The Lead Director

who is currently the Chairman of the Audit Committee, reviews and provides input on full Board meeting agendas, and plays a central role in developing, managing and overseeing our annual Board self-assessment process along with the Chairman of the Nominating and Corporate Governance Committee. The Lead Director acts as chairman of executive sessions of our independent directors and also provides the medium for informal dialogue with and among independent directors, allowing for free and open communication within that group.

For example, the Lead Director frequently holds informal conference calls with our independent directors prior to our quarterly Board meetings to discuss any issues the directors would like raised at the Board meetings. In addition, the Lead Director serves as the communication conduit for third parties who wish to communicate with the Board.

The Company'sOur current Lead Director is Mr.

Bowers.Malone.

The Board carefully considers the effectiveness of the Board leadership structure at least annually in connection with its self-assessment.

Executive Sessions of Non-Management and Independent Directors Pursuant to our Corporate Governance Guidelines and the NYSE rules, in order to promote open discussion among independent directors, our Board devotes a portion of each regularly scheduled Board meeting to executive sessions of only independent directors. See "—“— Director Independence"Independence” for a list of our independent directors. The Lead Director acts as chairman of each of the executive sessions described above.

Communications with the Board Stockholders and other interested parties may communicate with the Board (i) by sending any correspondence they may have in writing to the

"Lead Director"“Lead Director” c/o the General Counsel & Secretary of Walker & Dunlop, Inc., at

75017272 Wisconsin Avenue, Suite

1200E,1300, Bethesda, Maryland 20814, who will then directly forward such correspondence to the Lead Director, or (ii) by e-mailing correspondence directly to the Lead Director at leaddirector@walkerdunlop.com. The Lead Director will decide what action should be taken with respect to the communication, including whether such communication should be reported to the Board.

Board Meetings and Director Attendance Pursuant to our Corporate Governance Guidelines, (i) we are required to have at least four regularly scheduled Board meetings in each calendar year and additional unscheduled Board meetings may be called upon appropriate notice at any time to address specific needs of the Company; and (ii) directors are expected to attend, in person or by telephone or video conference, all Board meetings and meetings of committees on which they serve. Our Board held

seven9 Board meetings in

2017.2022. Each of our directors

serving on the Board in 2022 attended at least 75% of the total regularly scheduled and special meetings of the Board and the committees on which he or she served. Additionally, pursuant to our Corporate Governance Guidelines, the directors are encouraged, but not required, to attend our annual meetings of stockholders.

TwoOne of the eight directors elected to the Board at the

20172022 annual meeting of stockholders attended the meeting.

Criteria for Board Membership The Board has adopted a policy to be used for considering potential director candidates to further the Nominating and Corporate Governance

Committee'sCommittee’s goal of ensuring that our Board consists of a diversified group of qualified individuals that function effectively as a group. The policy provides that qualifications and credentials for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board. However, at a minimum, candidates for director must possess:

•

high integrity;

•

an ability to exercise sound judgment;

•

an ability to make independent analytical inquiries;

•

a willingness and ability to devote adequate time and resources to diligently perform Board duties; and

•

a reputation, both personal and professional, consistent with the image and reputation of the Company.

In addition to the aforementioned minimum qualifications, the Nominating and Corporate Governance Committee also believes that there are other qualities and skills that, while not a prerequisite for nomination, should be taken into account when considering whether to recommend a particular person. These factors include:

•

diversity, age, background, skills and experience;

•

personal qualities and characteristics, accomplishments, and reputation in the business community;

•

knowledge and contacts in the communities in which the Company conducts business and in the Company'sCompany’s industry or other industries relevant to the Company'sCompany’s business;

Table of Contents

•

ability and willingness to devote sufficient time to serve on the Board and committees of the Board;

•

knowledge and expertise in various areas deemed appropriate by the Board;

•

fit of the individual'sindividual’s skills, experience, and personality with those of other directors in maintaining an effective, collegial and responsive Board;

•

whether the person'sperson’s nomination and election would enable the Board to have a member that qualifies as an "audit“audit committee financial expert"expert” as such term is defined by the SEC; and

•

whether the person would qualify as an

"independent"“independent” director under the

NYSE'sNYSE’s listing standards and our Corporate Governance Guidelines.

Neither the Nominating and Corporate Governance Committee nor the Board has adopted a formal policy with respect to diversity of its directors. However, in connection with its overall director candidate review, the Nominating and Corporate Governance Committee does consider diversity of experience in areas that are relevant to the

Company'sCompany’s activities, including, for example, experience in commercial real

estate; technology;estate, commercial lending, technology and

finance.finance and experience as a board member of a publicly traded company. The Nominating and Corporate Governance Committee also remains committed to ensuring women and underrepresented racially/ethnically diverse candidates are included in every pool of individuals from which new Board nominees are chosen. This commitment is evidenced by the fact that each of the last three directors added to our Board are women or underrepresented racially/ethnically diverse. Directors must be willing and able to devote sufficient time to carrying out their duties effectively. The Nominating and Corporate Governance Committee takes into account the other demands on the time of a candidate, including, for example, occupation and memberships on other boards.

The Nominating and Corporate Governance Committee will seek to identify director candidates based on input provided by a number of sources, including (i) Nominating and Corporate Governance Committee members, (ii) our stockholders and (iii) others as it deems appropriate. The Nominating and Corporate Governance Committee also has the authority to consult with or retain advisors or search firms to assist in identifying qualified director

candidates; however, we do not currently employ a search firm, or pay a fee to any other third party, to locate qualified director candidates.

As part of the identification process, the Nominating and Corporate Governance Committee considers the number of expected director vacancies and whether existing directors have indicated a willingness to continue to serve as directors if re-nominated. Once a director candidate has been identified, the Nominating and Corporate Governance Committee will then evaluate this candidate in light of

his or hertheir qualifications and credentials, and any additional factors that it deems necessary or appropriate. Existing directors who are being considered for re-nomination will be re-evaluated as part of the Nominating and Corporate Governance

Committee'sCommittee’s process of recommending director candidates. The Nominating and Corporate Governance Committee will consider all persons recommended by stockholders in the same manner as all other director candidates, provided that such recommendations are submitted in accordance with the procedures set forth in our bylaws and summarized below.

After completing the identification and evaluation process described above, the Nominating and Corporate Governance Committee will recommend to the Board the nomination of a number of candidates equal to the number of director vacancies that will exist at the annual meeting of stockholders. The Board will then select the

Board'sBoard’s director nominees for stockholders to consider and vote upon at the

stockholders'stockholders’ meeting.

Board Refreshment

The Board refreshes its membership through a combination of adding or replacing directors to achieve the appropriate balance of maintaining longer-serving directors with deep institutional knowledge of the Company and adding directors who bring a fresh perspective. At the time of our Initial Public Offering (IPO) in 2010, the Board was comprised of eight directors, six of whom were not members of management and five of whom were independent. Since our IPO:

•

four of the six non-management directors who were serving on the Board as of our IPO have left the Board;

•

the Lead Director and the chairs of the Audit, Compensation and Nominating and Corporate Governance Committees have changed, and all three members of our Audit Committee joined the Board after our IPO; and

•

we have expanded the representation of women and underrepresented racially/ethnically diverse individuals on our Board to comprise four of our eight directors, and each of the last three directors added to our Board are women or underrepresented racially/ethnically diverse.

Engagement with Stockholders

We engage frequently and actively with our stockholder base through participation in conferences, non-deal roadshows in partnership with sell side analysts, and company-organized one-on-one or group meetings and conference calls. In 2022, we traveled for various in-person investor conferences and meetings, but it is apparent that virtual conferences and meetings remain the preference for many investors. Virtual meetings are a very efficient way to conduct a day of meetings with investors across the world, and as a result, we will continue to participate in virtual events (in combination with in-person meetings) for the foreseeable future. A summary of 2022 in-person and virtual outreach is listed below:

•

participated in eight investor conferences hosted by sell side analysts;

•

held over 110 meetings with buy side investors and sell side analysts;

•

held the 2022 annual meeting of stockholders in person; and

•

held a virtual Investor Day to provide progress updates on our current five-year business strategy, Drive to ‘25, described more fully below, which had over 430 attendees.

During these meetings, we discussed macroeconomic conditions affecting our competitive environment and our business, our financial and operating results, our five-year business strategy, our corporate governance and other matters of executive compensation and our environmental, social and governance (“ESG”) initiatives.

Our Strategy and Alignment of Director Skills and Experience

Our mission is to become the premier commercial real estate finance company in the United States. In support of that mission, we adopted a five-year business strategy in 2020, named Drive to ‘25.

Our Drive to ‘25 strategy is centered around growing debt financing volume, expanding our property sales platform, building investment banking and asset management capabilities, and achieving ambitious environmental and social goals. Our Drive to ‘25 strategy includes the following five-year operational, financial and ESG targets to be achieved by year-end 2025:

| | Operational | | | Financial | | | ESG | |

| | •

$65B+ in Annual Debt Financing Volume, including $5B+ in Annual Small Balance Loans •

$160B+ Servicing Portfolio Balance •

$25B+ in Annual Property Sales Volume •

$10B+ in Assets Under Management | | | •

At least $2B in Annual Total Revenues •

At least $13.00 per share in Annual Diluted Earnings Per Share (“EPS”) | | | •

Increase Diversity of Leadership •

Reduce GHG Emissions Intensity •

Donate 1% of Annual Income from Operations to Non-profits •

Originate a Cumulative $60B of Affordable Housing Debt Financing Volume from 2021 – 2025 | |

To achieve these ambitious targets, we are focusing on the following areas:

•

defending our market position as a leading provider of capital to multifamily borrowers;

•

continuing to expand our loan origination and property sales teams;

•

continuing to develop and deploy technological products and improvements across our businesses;

•

establishing commercial real estate investment banking and advisory capabilities and growing our existing commercial real estate (“CRE”) investment management activities through organic growth and via acquisitions; and

•

continuing to invest in programs and activities that enhance our overall ESG impact as described below in “ENVIRONMENTAL, SOCIAL AND GOVERNANCE.”